Thursday, March 29, 2007

Brady Bonds

Brady bonds make an interesting example trade.

With a Brady, it is usually just the capital that is guaranteed, and not necessarily for the entire period of the bond.

That means the different issuer risks need different calculations.

It also means that to price a Brady, you would need a curve for the guarantor as well as curve for the issuer.

Interesting problem to think about and how to code it in a generic way

- There is a counterparty risk to the trade, as with any bond

- There is an issuer risk to the issuer of the bond

- There is another issuer risk to the guarantor of the bond

With a Brady, it is usually just the capital that is guaranteed, and not necessarily for the entire period of the bond.

That means the different issuer risks need different calculations.

It also means that to price a Brady, you would need a curve for the guarantor as well as curve for the issuer.

Interesting problem to think about and how to code it in a generic way

Tuesday, August 09, 2005

Reconciliation

Some reconciliations need to be balanced.

For example, if comparing a trade order against several trade fills, then we have the situation where the total number of, say, bonds ordered should be the same as the number of trades filled. Since its an likely to be an accounting problem where the fills will have a different sign. That means the balance will be zero.

For example, if comparing a trade order against several trade fills, then we have the situation where the total number of, say, bonds ordered should be the same as the number of trades filled. Since its an likely to be an accounting problem where the fills will have a different sign. That means the balance will be zero.

Monday, August 08, 2005

Classes with FSM

Classes with finite state machines are an example which OO supports badly.

The test is to look at the object's identity. If you are copying identity from one class to another, then you have probably been caught.

Take a simple account class. You decide to split it into two classes, active account and dormant account. The bank account number is going to be common, and you want to prevent having two accounts, one active, one dormant with the same account number.

In reality, dormant or active is a state on the account.

Different classes were made because the data relevant to each class is different.

What is needed is an abstract base class, account, with two sub classes, dormant and active.

The test is to look at the object's identity. If you are copying identity from one class to another, then you have probably been caught.

Take a simple account class. You decide to split it into two classes, active account and dormant account. The bank account number is going to be common, and you want to prevent having two accounts, one active, one dormant with the same account number.

In reality, dormant or active is a state on the account.

Different classes were made because the data relevant to each class is different.

What is needed is an abstract base class, account, with two sub classes, dormant and active.

Development driving class heirarchies

Sometimes the development process drives the class heirarchy. Trade and order are a good example where there usually are two separate teams developing different subsystems or systems. The benefits of having a common class heirarchy are lost because they don't, can't or aren't allowed to work together.

Prototypes don't make good base classes

Take the example of trade and order. Both good prototypical examples like tree and fir are for trees. However both miss the base class.

ie. Look for base classes.

ie. Look for base classes.

Named Scenarios

Named scenarios are a good idea. You can then save a particular set of shifts or stress tests.

The tool should also be able to generate actual scenarios. For example, give it two dates, and that determines all the shifts. ie. The changes in the summer of 1998 would be a Russian crisis scenario.

The tool should also be able to generate actual scenarios. For example, give it two dates, and that determines all the shifts. ie. The changes in the summer of 1998 would be a Russian crisis scenario.

Monday, June 20, 2005

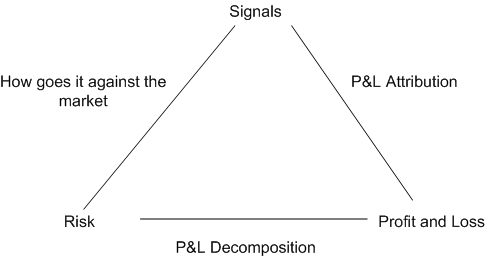

The reporting triangle

Crossing and Netting

Two terms that define related but separate ideas.

Netting is when you trade buy 20, sell 15 with the same counterparty, and so only pay for and deliver 5.

Crossing is taking two orders from different counterparties and just executing the difference. The problems are when the two net to zero, and what the market regulations happen to be for the market on which they are traded.

Netting is when you trade buy 20, sell 15 with the same counterparty, and so only pay for and deliver 5.

Crossing is taking two orders from different counterparties and just executing the difference. The problems are when the two net to zero, and what the market regulations happen to be for the market on which they are traded.

Wednesday, August 25, 2004

Credit limits

Its a multiway join between parties. Typically external and internal. However, it could be external-external if you are managing other people's limits.

Make sure there is a field for external utilisation.

Make sure there is a field for external utilisation.

Monday, July 26, 2004

www.xbrl.org"

XBRL is a language for the electronic communication of business and financial data which is set to revolutionise business reporting around the world. It provides major benefits in the preparation, analysis and communication of business information. It offers cost savings, greater efficiency and improved accuracy and reliability to all those involved in supplying or using financial data."

XBRL is a language for the electronic communication of business and financial data which is set to revolutionise business reporting around the world. It provides major benefits in the preparation, analysis and communication of business information. It offers cost savings, greater efficiency and improved accuracy and reliability to all those involved in supplying or using financial data."

Information About XBRL (Extensible Business Reporting Language)

Information About XBRL (Extensible Business Reporting Language)

XBRL is an xml markup language for finacial reporting.

XBRL is an xml markup language for finacial reporting.

Ratios for Financial Statement Analysis

Thursday, July 01, 2004

Moody's KMV White Papers - Single Obligor Credit Risk (Default Risk)

Moody's KMV White Papers - Single Obligor Credit Risk (Default Risk): "Modeling Default Risk"

gummy stuff ... about Investing (mostly)

gummy stuff ... about Investing (mostly)

A nice site about maths and fianance at a very simple level.

A nice site about maths and fianance at a very simple level.